Masks Off, part 2: Zero Lessons Learned from the Great Financial Crisis

We may be in a centrally-planned market that would make Hitler blush (he did the same thing with the German markets)

Photo by Llanydd Lloyd on Unsplash

Topics covered in this post:

Introduction

Financial & Economic

Blackrock Didn’t Introduce ESG & Woke to the Financial World - Kofi Anon Did (Former UN Chief)

Was the War on Drugs Ever Meant to Be Won (it’s the economy, stupid)?

Foxes Guarding the Henhouse

Cooked Markets

Fin

Introduction

To begin with, this post was supposed to round out the Masks Off posts, but there is so much to cover on one section of the topics I wanted to cover that it has to be its own. The name may scare some of you off because it deals with stocks, markets, and economics, but I boiled it down to make it as easy to digest for everyone as possible.

And there’s pictures to make it even easier to follow!

These topics are important for several reasons:

It touches every single one of us in major ways, unless you are 100% removed from society and off the grid, as this is the entire US (and global) economy.

It outlines how the same people & institutions that led the world into the Great Financial Crisis of 2008-2009 are back at it again - and are likely to wreck the global economy again.

It quantifies (with receipts) something that I’ve been trying to quantify since 2021 when I first began to see it but couldn’t wrap my arms around the 5Ws at the time.

I have many friends and family who ask me what to invest in and look at me cross-eyed when I tell them to stay away from the markets right now.

The following (especially the last section) is why. We don’t know when the house of cards will fall, but there’s a high likelihood (with plenty of historical precedent) that these types of manipulations will lead to bad outcomes.

As an MBA and entrepreneur who has worked for several large and a few Fortune 500 companies, it pains me to say this: we no longer live under capitalism in the USA. I said that in the previous Masks Off post, but this one really drives the point home.

Seeing this and finally being able to quantify it is sort of like the meme from The Matrix: I’ve known that something was off in a major way since I noticed aberrations within the markets in 2021, and now that I’ve “seen it” all I see are the “1s and 0s” of manipulation everywhere.

Financial and economic topics can turn people off, but this is not going to be an Econ 101 or high-level trading lesson.

I’ve added asides and definitions where I thought they were needed because everyone who participates in the economy, markets, or buying anything in the USA today will be affected by the things outlined below.

So let’s dive in.

Financial & Economic

Any castles built in the sand are bound to be washed away by the ocean at some point, and the tide is coming in.

On the day that I’m writing this section (June 9), it seems the petrodollar deal that the US and Saudi Arabia have had for 50 years is coming to an end. The petrodollar helped to power the US Dollar (USD) hegemony and assurance as the world’s reserve currency up to this point.

Energy security is national security for any industrialized or emerging economy, and the need to buy oil in USD ensured that every major global player had plenty of them on hand.

Vince Gil aka “Roaring Kitty” has opened a considerable number of eyes to one way that the US stock market is rigged, forcing the hand of the exchanges, regulators, and “very serious people” to halt GME trading yet again to stop him from pushing short sellers into billions of dollars worth of realized losses.

It also showed the world, via the spotlight that he put on the stock, that somehow there were more shares being traded than actually existed for GME.

As a result of him putting these fixers under such a bright light, it was announced that an investigation was being opened up into him for stock manipulation. Within the same 24-hour period of the announcement of that investigation, Jim Cramer asked Securities and Exchange Commission (SEC) Chair Gary Gensler on live television whether or not members of Congress should be investigated for insider trading.

Gensler gave an extremely political non-answer, of course. Please watch the clip below:

https://x.com/unusual_whales/status/1799501897918828866

If you don’t know, Gensler, the current head of the SEC, was the CFO for the Hillary Clinton election campaign that mischaracterized payments to the political operatives who created, pushed, and delivered the RussiaGate Hoax fraud to the media and FBI.

While Trump had to go through an extremely Stalinist show trial in NY for the same alleged crime - despite Trump using personal funds but Clinton using campaign funds - there were no charges for Hildawg except for a fine that the Clinton campaign had to pay.

Gensler is also long-time associates with the parents of Sam Bankman Fried, the infamous SBF who bilked crypto investors out of billions and was the top donor to democrats (and a lot of republicans) while also having some sort of multi-billion dollar money laundering scheme cooking in Ukraine that nobody wants to investigate.

Take a moment to fully understand that the things outlined above are only the tiniest of fractions of the corruption and ridiculousness of our markets, regulators, and financial system - and they are only a few of the current ones that are right out in the open.

What we’re about to wade through are things that are hidden from the average person, but the availability of data, and the potential to crowdsource questions & widely disseminate answers have put us in a unique position to identify and spread the information about what the “adults in charge” have done to build our entire economy, stock market, and monetary policy on the shakiest of foundations.

Blackrock Didn’t Introduce ESG & Woke to the Financial World - Kofi Anon Did (Former UN Chief)

Let’s start off with a reality about Big Finance that has been an issue brewing for quite some time that only really came to the forefront of most people’s attention over the past several years.

Whether we’re talking about ESG, CRT, DEI, or any of the other woke and/or green elements that have been shoved down our throats, there are some major misconceptions about where it all came from.

Some believe it was purely a Marxist push by the universities as part of their “long march through the institutions” strategy.

While this was an aspect of it, take a moment to consider that the commie-leaning gender studies PhD student doesn’t really have all that much influence on Fortune 500 companies, who were at the forefront of pushing a lot of this into greater society beyond the educational space.

Remember Coca-Cola and its “be less white” campaign?

Bank of America, a company founded by Italian immigrants who loved this country and yet the bank donated an obscene amount of money to a Marxist domestic terror organization that had the core goal of “destroying the nuclear family” listed on its public website?

Target donating to the very same group, having its own stores burned down and/or looted after those massive donations, and then moving right into selling pride gear and “supporting” companies that had explicit satanic messaging and advocated for mutilating children?

And of course, the most egregious is Disney, a company originally formed by vehement anti-Communist Brother Walt who testified for McCarthy’s committee to root commies out of Hollywood, funded his own foundation to fight back against stateside commies - only to have the current iteration of his company taken over by Marxists and executives who seem dedicated to pushing their messaging into every home.

The Marxist infiltration into US academia is easy enough to track, for those of us who know about the Frankfurt School (German Marxists and progenitors of Critical Race Theory) who came to the US and joined Columbia University in 1935:

The Marxist push into Big Finance, which used capitalism (access to capital) to push these harmful and society-destroying policies into boardrooms across the US started in 2004.

That was when Kofi Annan (former Secretary General of the UN) wrote a letter to the CEOs of 50 major global financial institutions and asked them to find ways to integrate what would soon become ESG criteria with the capital markets and investment portfolios.

The term ESG investing was first seen in 2005 as a part of a study centered around the "Who Cares Wins" conference by the UN and the International Finance Corporation (IFC).

The ESG criteria and financial factors morphed out of Socially Responsible Investing (SRI), which has been around far longer than ESG but focused mainly on negatively screening out investment portfolio options with moral & ethical criteria. The practice of proactively choosing investments based on specific factors was birthed in the ESG movement.

The idea was that bringing environmental, social, and governance factors in line with the capital markets made sense from a business perspective and would lead to a better world for all.

As usual, don’t take my word for it:

https://www.forbes.com/sites/georgkell/2018/07/11/the-remarkable-rise-of-esg/?sh=70b5d0861695

https://www.unepfi.org/fileadmin/documents/freshfields_legal_resp_20051123.pdf

The idea was (sold as) a way to bring ESG in line with capital markets, but it ended up being a Frankenstein of terrible ideas that companies were forced to fall in line with if they wanted access to capital.

How were these ideas forced upon the nation’s largest publicly-held companies?

Two ways, mainly.

First, Blackrock, Vanguard, and State Street each own majority shares of each other, and there are some allegations of very questionable political alliances from both sides of the “two parties” (see: uni party) old families who have major private ownership in them through shell companies.

These three firms own controlling interest in over 90% of the S&P 500 companies, which means they can decide if a CEO gets to keep his job or hit the road. This is called leverage, and Larry Fink has said on previously publicly disclosed earnings calls and in public statements that he was willing to fire CEOs that didn’t fall in line with his diktats.

https://www.cnn.com/2020/11/24/business/blackrock-vanguard-state-street-biden/index.html

https://www.economicliberties.us/our-work/new-money-trust/

For those companies whose CEOs were not under the thumb of Fink and his ESG demands directly, access to capital could be used to control them.

Why would a major Fortune 500 company have to worry about money and access to capital?

To truly understand this requires an understanding of the daily machinations of a large, global corporation.

Let’s put it this way: just because a company may have $10 billion “in the bank” (cash reserves) on paper doesn’t mean that it actually has that money at the ready to be deployed for payroll, purchases, etc.

Additionally, large global companies can often make a lot of money in rate arbitrage when money is “cheap.”

This means that when borrowing rates are low (as decided by The Fed), a company may make more money by having their assets deployed (at work or invested) than by using that capital to buy new equipment or other capital expenditures.

Like families who may use a credit card with low rates or take on a mortgage rather than paying cash for a home due to having a great credit score, the company can “make money” (arbitrage) by getting low finance rates on capital expenditures rather than using their own capital to make the purchase in cash.

If a company had a low ESG score or was unwilling to go along with the “Big 3” (which quickly morphed into nearly all of the big banks), that access to capital quickly dried up.

As CEOs of public companies can often be quickly fired for missed earnings, growth, or declining share prices, that access to capital becomes extremely important to them.

This is a point that many don’t quite understand and couldn’t wrap their minds around in the 30-second sound bites through which the whole ESG/woke push was delivered via the conservative MSM networks and most pundits.

Many of the CEOs and even board members of these companies weren’t “all in” on the wokeness they pushed through advertising and corporate policies - they needed to push those policies in order to maintain access to capital markets, and thereby keep their jobs.

This is why the decision for Kofi Anan to go to the heads of the largest banks & financial institutions was brilliant.

If he were being honest and altruistic, it would be an excellent way to make a huge impact.

I have no qualms about saying that I think the UN is a nefarious organization and has been since its creation, and if my thesis is correct, it was also a brilliant way to destroy capitalism and capitalistic nations by going directly to the trailhead of capitalism - the capital markets and those who facilitate them.

Was the War on Drugs Ever Meant to Be Won (it’s the economy, stupid)?

I randomly came across a mini-series (8 total episodes) on Amazon Prime last year when looking for something to watch that quickly made it on my Top 10 list of all time.

It’s a bit of a cult favorite for me among my circle, because I don’t know many who’ve seen it - although it is brilliant and covers so many global issues in one sitting.

The series is called Zero, Zero, Zero, and I could not recommend it more highly. Heads up, it’s not for the faint of heart.

The series tells the tale of one of the largest black markets in the world, and how it interconnects with gray and even white markets when all is said and done. The movie Sicario, especially the opening scene and financial aspects of it, helps to paint this picture more brightly.

The POV in Zero, Zero, Zero changes between several vantage points throughout the series, as it’s a story that weaves together a handful of global issues into one.

With the main POV being told through a single father and his family who own a shipping company based in New Orleans, the story is one of a massive shipment of cocaine that is ordered by a mafia don in Calabria, Italy.

What in the world does a shipment of cocaine have to do with the global economy?

There’s a quote said by the character played by Gabriel Byrne (of The Usual Suspects, among other accolades) that sums it up quite nicely:

“You know why we’re not gonna lose money on this? Because what we do keeps the world’s economy afloat.”

That may strike you as a bit of hyperbolic Hollywood screenwriting if you’ve never looked into the sheer size of the global drug black market or the human trafficking market that is now far more profitable for cartels than the “Bolivian marching powder (cocaine).”

First off, let’s be clear: this series was taken from a book written by the same author who wrote Gomorrah, which was also turned into a cult phenomenon detailing the seedy modern-day underworld of the Old World Italian mafia and its operations.

He gets it.

A RAND report in 2022 cited the global drug trade at a worth of around $652 billion, with $150 billion of it coming from the USA alone.

A US Congressional report cited the cartels as making an estimated $13 billion from human smuggling in 2021 alone - before those operations were ramped up massively thanks to the US State Department and Biden administration.

I would put both of those estimates as way, way under the actual numbers, but by their very nature, the actual numbers are extremely difficult to quantify.

Reports of the CIA starting the crack epidemic due to smuggling cocaine to fund off-book wars and operations aside, the global drug trade brings in so much money that it has been able to hire armies of financial wizards, lawyers, and intelligence operatives who’ve spent their entire lives hiding the true sources of money and finding ways to move it from black (illegal) to gray (illicit) to white (legal) markets so that it can be washed without anyone knowing the difference.

If anyone finds out or begins sniffing in the wrong places, there are always wetwork teams to take care of the problems.

https://www.amazon.com/Dark-Alliance-Gary-Webb-audiobook/dp/B00GSXMRIG/

While Zero, Zero, Zero tracks the circuitous route of cocaine moving from Columbia through Mexico, across the ocean, making a pit stop in Africa (where the characters have to deal with both police and terrorists), and then back across the ocean to Italy, Sicario touches on a point that hits much closer to home - but you may have missed it given all the action in the movie.

At the beginning of the movie, the opening scenes take place in an Arizona house near the Mexican border where the FBI believes some kidnapped citizens are being held.

Dialogue post-raid reveals that the home was identified as one owned by “shell companies within shell companies” that own hundreds of homes in the region, that can’t be directly tied to but are known to be owned by a cartel “jefe” living in the US.

When they begin running operations to force a reaction, the first move is to freeze bank accounts.

In doing so, they discover one fully legal loophole that was exploited to hide the true financial records: bank managers using lines of credit that are extended and repaid, thereby going around the $10,000 reporting loophole for US banks that is meant to track potential money laundering.

If you didn’t see the Tucker interview with comedian Seth Dillon, there is a section where Seth talks about the many residential buildings in NYC that are totally unoccupied and owned by foreigners as a way to hide and/or launder money:

This is not the only interview in which Seth talks about this topic, and Seth isn’t the only one who has mentioned it.

While the IRS and US tax laws require the average citizen to go through a financial proctology exam to buy or own property, foreign interests who can pay in cash through shell corps don’t have to deal with nearly as much disclosure hassle.

It’s been a well-known and publicized fact that corrupt Chinese oligarchs trying to squirrel money away that the CCP couldn’t touch are part of the reason that California home prices went parabolic in the past decade, with many buyers offering cash over the asking price.

What was one of the other “hot” real estate (and AirBnB) locations during the height of the hottest of home sales markets?

Arizona, and Phoenix, specifically.

I’ve been to Phoenix, and it’s a lovely enough town. But can you name a single attribute about Phoenix that would make it worth being one of the hottest housing markets in the country?

To be perfectly candid the market is falling apart there right now, but this is an anecdote to help explain a greater phenomenon.

Besides being a hot, arid desert, Phoenix has one major attribute that makes it attractive to someone who may have a need to find somewhere to move money from the black market to the white market: proximity to the southern border.

With over 100,000 Americans dying of fentanyl overdoses every year, quite a few within the populace, and now a handful with large platforms like Tucker Carlson and Shawn Ryan, have been asking why nobody “in charge” seems to care in the least bit.

Some politicians have gained a little “earned media” by putting out sound bites about going after the cartels, but no serious movement has been made in that direction.

Why not? If they have a hand in killing more American citizens than any war we’ve taken part in, why doesn’t anyone do anything to stop or even slow it?

What if taking out the cartels meant sucking so much money out of our economy, and how it touches multiple hands & wets so many beaks by being “washed” from black to white, that it would wreck the US economy?

Before you write this idea off as ludicrous, remember that megabank HSBC was caught not that long ago installing custom teller windows so that cartels could drop off boxes of cash at their preferred banking locations:

Foxes Guarding the Henhouse

We touched on the uber-swampy connections of SEC Chair Gary Gensler above, but he’s far from the only swamp creature who has been put in a position to “monitor” financial and economic markets despite shady connections, backgrounds, and actions.

Of course we had the WikiLeaks revelations that Citigroup got to pick much of Obama’s first cabinet:

Investing insights platforms like Unusual Whales and Quiver Quantitative (pictured below) that have popped up to allow retail investors to copy the unusually profitable portfolios of US Congress members like Nancy Pelosi:

Federal Reserve (The Fed) members were caught trading in ways and using information that was very much outside of what they were allowed to do:

https://www.axios.com/2022/10/14/bostic-violated-fed-trading-rules-atlanta

And of course, this beauty. In case you forgot, the CEO of Silicon Valley Bank was on the board of the San Francisco Fed when his bank failed:

Senator Kennedy (R-LA) was one of the few to say anything of substance about this:

Cooked Markets

There are a lot of technical details behind what I’m going to try to explain next in an extremely non-technical and high-level view so that everyone can understand it.

It’s also something that is incredibly hard to believe given the scale of time, (US taxpayer) money, and effort that is required to pull this off.

For those of you who understand markets and the technicals of how they operate and want to dive deeper than my explanation will be, here is a post on the X platform (formerly Twitter) that has the links to a bunch of threads that break down the technical details - with receipts and Trading View/Bloomberg Terminal screenshots, of course:

https://x.com/frankoz95967943/status/1547910347398344707

The screenshot above is just one snapshot of a long list of threads that detail intricate machinations of our global markets, how they are interconnected, and most importantly for this post/section, how they are being manipulated.

If you’re a casual follower of investment or markets news, you may have heard the “old hands” of investing and trading bemoaning that absolutely ridiculous P/E ratios for the “5 stonks” (stocks) that are essentially driving the entire stock market right now.

You may have wondered why investing guru Warren Buffett called cash “an attractive position to be in right now” to the point that he has $189 billion sitting in cash for his investment portfolio at the moment.

If those things sound odd to you because those you follow for investment advice have been telling you about the “strong bull market” that we’re in, then I’m sorry to be the one to break all of this to you.

Firstly, 7 stocks have pretty much driven all positive market returns for the past year, and it’s been down to only 5 for the past couple of months.

In the first two Shitshow Macro posts, I talked about investor Michael Green and his thesis that passive investing “broke” the Black Scholls formula (a part of how all options contracts are priced), and how those responsible for the passive investing market now being over 50% of the stock market (Blackrock and Vanguard, mentioned above) have no “unwinding strategy” for if their sale orders ever exceed buy orders for their passive business.

In case you need a refresher, he has models where that scenario takes the market to $0 because of the nature of passive investing, it keeping less cash on the side to seize upon opportunities, and because passive investing is literally based on “buy or sell at any price.”

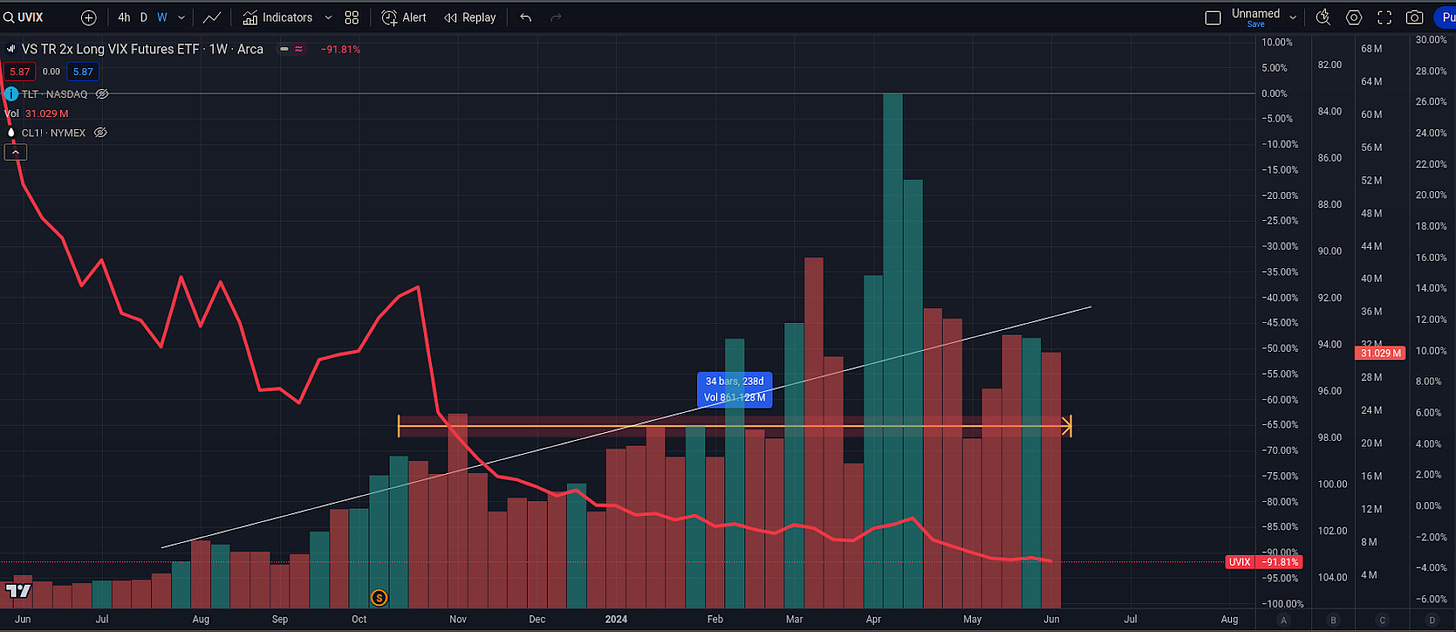

The Manipulated Vix Crush

You’ve likely heard the saying that “markets prefer certainty,” and one way of measuring how happy the markets are in that respect is through volatility.

Or, at least, it used to be when they weren’t messing with it.

There are several ways to measure (and invest in/bet on) volatility, either directly, levered (with leverage), or in its inverse:

VIX (CBOE Volatility Index)

SVIX (1x Short VIX futures ETF) -> short means you’re betting on the opposite (inverse) direction of movement

OVX (CBOE Oil Volatility Index) - we will get into why oil and its volatility is a crucial aspect of everything later

There are actually far more volatility index tickers out there, but these seem to be the main culprits behind the shenanigans that we’re talking about.

In size of the scale of money and trades within markets, for the US, they go within this order (decreasing from largest to smallest):

Treasuries

Bonds

Options

Stocks (or stonks, as the cool kids say these days)

There are more options contracts traded on a daily basis than actual stocks, and volatility goes into the pricing of every single options contract.

In a normally functioning, non-manipulated market, when VIX goes up stocks go down, and when VIX goes down, stocks go up.

That sounds extremely basic to the casual observer, and of course, there are many levels of velocity and veracity with which the market goes up or down - as well as aberrations & outliers - but this used to be a general rule of thumb.

VIX (volatility) is generally known as the “fear” index, and in a normal market a high volume of sudden sales results in the VIX jumping upwards, and a market steadily climbing upwards results in the VIX dropping down.

We have not been in a normally functioning, non-manipulated market for several years, however.

I first noticed this when I was trading options exclusively, and even though I could see it with my eyes and know that it was happening I couldn’t quantify it.

The thread linked at the start of this section does quantify it and calls it the “VIX crush” with the thesis that it is being used to ensure the markets only go up.

Those of us who have been paying attention assume that it falls in line with the fake BLS and other data that have been used so that the current White House administration can gaslight people about the “strong and robust economy.”

I know it sounds nuts. Are the Federal Reserve and The Treasury directly intervening in the stock market for purely political means?

Oh, bubbie…it gets worse.

The account above provides plenty of receipts for the 5Ws of said stock market manipulation, but that’s not the worst part by far.

Let’s get into a hypothetical conversation that X account Expound the Profound posted to help understand, in a slightly funny way, how this predicament may have come to fruition.

Again, this is a slightly comical hypothetical, and at least one of the players involved certainly had a stand-in if this is anywhere near how it actually came to be - but the broad strokes are likely accurate:

How I see the whole “we gun crush the VIX to control oil” decision came about…

JPOW (Jerome Powell): Mr. President - we have a problem - we accidentally left interest rates too low for too long.

Biden: And what’s the problem?

JPOW: We can no longer control inflation. We raise rates but oil won’t go down.

Biden: What does oil have to do with inflation?

JPOW: Well, oil is in everything, Mr. President. If the price of oil goes up, that’s inflation. We raise rates to slow demand but it’s just not working.

Biden: Well just raise interest rates more.

JPOW: Well sir, we’ve been doing that and it’s crashing the stonk market…and oil isn’t responding.

Biden: We’ll we got the SPR. I will just drain the SPR.

JPOW: Mr. President - at our consumption rate that alone won’t get oil prices down…you can only suck 4mm barrels of oil a day out of the SPR…and if we raise rates much higher we are going to crash the stock market.

Biden: Why would raising rates crash the stock market?

JPOW: Well, when we raise rates it impacts the volatility index or “the VIX.” Options pricing is very highly influenced by the volatility of oil and interest rates.

Biden: Well, then just control the VIX. You can do that right?

JPOW: Well, yes, we’ve done it in the past under special circumstances.

Biden: Wouldn’t this be a special circumstance? I mean I’ve got an election coming…

JPOW: Well, yes, I suppose so…

Biden: You seem hesitant, what’s the problem?

JPOW: Well, Mr. President - as you know - controlling prices is literally price controls - it’s not capitalism. The Fed prefers not to mess with pricing mechanisms of the market - other times we tried this things blew up spectacularly.

Biden: Well then don’t lose control.

JPOW:

Biden:

Contango, Carry Trades, The Spice (Oil) Must Flow

What likely caused things to get so bad in the oil prices and markets to get to the point where The Fed would need to go full commie China and Stalin centrally-planned economy with the platform that’s supposed to be the epitome of free market capitalism (the stonk market)?

Again, Expound the Profound helps to set the stage (without hypotheticals this time). Taken from his thread that you can find here:

https://x.com/frankoz95967943/status/1787681284099350769?t=xrjM_LFJjwzUdnWUzDDUhQ&s=19

Why is MBS a pariah and Putin must not remain in power? Why did Gadaffi and Saddam have to die?

Because of oil.

Oil is inflation.

Inflation is any country’s Achilles heel - in particular the US and in particular for oil.

The carry trade (arbitrage between spreading yields) helps smooth out oil shocks. But when Putin - after warning for months Ukraine could never be part of NATO - invaded Ukraine the carry trade wasn’t enough to suppress oil volatility.

Biden tried to smooth the markets by selling off the US Strategic Petroleum Reserve (SPR) and G7 central banks tried to up the carry trade.

It wasn’t enough.

Likely in January 2022 - after seeing Putin amass troops on Ukraine’s border - G7 hatched a new plan - directly shorting the VIX and coordinated US Treasury purchases among themselves to weaken the dollar together.

Putin invaded in February 2022 and it produced an oil shock.

At the same time, China moved into open oil settlements in the Shanghai exchange.

In March 2022, G7 realizing the worst thing possible for inflation, took action and began executing their plan.

UVIX and SVIX were launched in March 2022 - the oscillations in oil were +/- 20 Basis Points (bps) per day - it was quite incredible.

Oil oscillated because speculators got involved and saw a major geopolitical crisis bid up the price of oil.

The VIX was going nuts.

When launched, SVIX was 9 and UVIX was over 100 - they both move in opposite directions.

Today?

SVIX is over 42 and UVIX is near 7 - after reverse splitting a few times.

Option pricing today all along the tenure has absolutely been destroyed.

For everything - stocks, futures, etc.

Now we have extreme moves in stocks - rising 8 to 10 points in a day, while oil is completely muted.

Commodities in general have been destroyed since March 2022 (chart them for yourself to see).

And stocks hovering near all-time highs.

This is how VIX crush works.

What you have now is what is called a “planned economy” - not unlike what you would find in communist China.

*my own note: Hitler instituted a law during his reign that the German stock market could only go up, and trades that would lower the price of any stock were forbidden. The US had to completely shut down and restart their market after the war. My, how far we’ve fallen for politics.

Back to the thread linked above…

VIX crush is a form of capital control - as long as stonk goes up, foreigners feel comfortable leaving money there and investing more.

But nearly all speculation is dead - especially on longer-dated tenure and especially for oil.

Leveraged inverse products like SQQQ and SPXS are now trading below par value at the money (go look for yourself).

We’ve moved from one extreme to the other.

1 year after the VIX was corralled, we had another event in 2023 when the banks failed due to bank runs.

This is because bond yields kept going up - no one anticipated that.

As the US kept screwing with oil pricing via VIX crush, OPEC kept cutting the supply of spice (oil).

Creating shortages in the market and forcing prices higher - to corral oil pricing - G7 had to let the bond yields go up.

When they did this it destroyed over-leveraged businesses like Commercial Real Estate (CRE) and speculative banks like Credit Suisse (CS) and Silicon Valley Bank (SVB).

Today interest rates are hovering near multi-decade highs - which is TERRIBLE for the stock and growth, but with VIX crush few can afford to bet against the stock market - VIX crush destroys premiums, especially for puts (bets on the share price of a stock or index going down).

To boot - big trading houses seeing what the government was doing with VIX crush adopted a “sell puts to finance calls” strategy.

They short puts naked (uncovered, or without holding a hedge), and with the premium they buy calls.

This puts DOUBLE upward pressure on the stock as market makers have to cover BOTH sides.

We now have something worse than a moral hazard.

There are P/E ratios on the stock well over 100…stocks are trading like shitcoins.

And the leverage within the stock market has grown to extremes.

Meanwhile, the real economy is a dumpster fire for more than 50% of Western labor.

At the same time, China is dumping fentanyl and flooding markets with goods shipped to Mexico to get around tariffs.

And at the same time the US is reindustrializing and entering a war footing - at a time when inflation is already red hot and the least privileged are suffering the most.

We have the makings of a “K” shaped recovery where the wealthy are doing fantastic and the poor are getting destroyed.

Welcome to the warped world of Bidenomics.

Too Big to Fail Goes Nuclear

We’ve all heard about the massive Commercial Real Estate (CRE) crisis that is set to wallop regional banks, right?

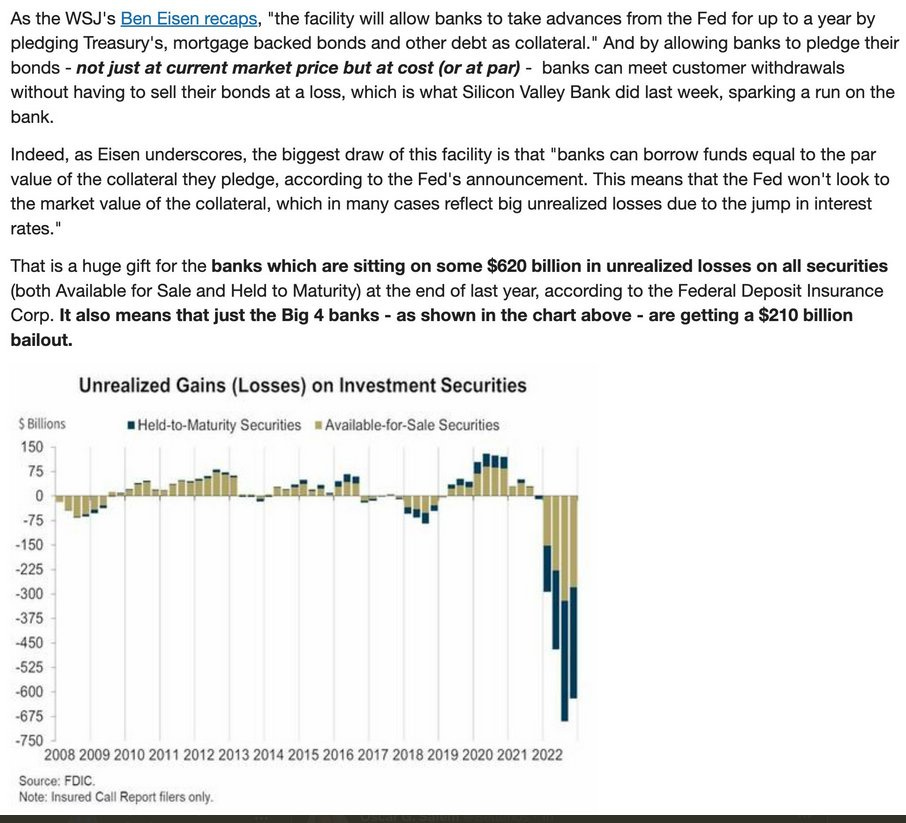

Does everyone remember the massive bailouts that the USGOV gave to the “too big to fail” banks in the 2008-2009 Great Financial Crisis (GFC) that made so many taxpaying Americans so angry (myself included)?

Especially when US taxpayer dollars went to very large bonuses for executives at the banks that broke the markets and those banks didn’t even ease lending as the bailouts were supposed to do?

And nobody was held accountable?

Those “massive” bailouts were about $500 billion in total.

In the past several years post-Coof, we’ve eclipsed that bailout amount by a significant margin.

Wait…we would have heard about that if our taxpayer dollars were being used to bail out banks again, right?

They would have had to tell us about it, right?

See, that’s the sly part. If you don’t call it a bailout, you don’t have to report it as a bailout.

And if you do publicly report other things with complicated names & mechanisms that people don’t take the time to understand, and financial pundits don’t tell people about, you can do it all in plain sight.

You see, here’s the thing: as outlined in the sections above, the USGOV knew that in order to keep inflation down as much as possible, it had to keep the price of spice (oil) as low as possible. To get away with its VIX crush and other market manipulations, it had to let bond yields rise.

That caused significant pain to a lot of banks, who weren’t given any true accountability after they blew up the markets in 2008-2009, and so of course they had gone full risk-on in real estate markets as soon as the smoke cleared.

And, of course, once yields started rising, those risky real estate bets threatened to blow the whole thing up yet again.

One of the few things that was supposed to hamstring the “too big to fail” banks post-2009 was the implementation of a few rules. The GOV even brought Volker back to the party to help them figure out how to do it, and he created a thing called The Volker Rule that was implemented in 2015.

What was The Volker Rule?

It essentially said that banks shouldn’t be able to invest in equities or the stock market.

Remember it was Mortgage Backed Securities (MBS) that were given a lot of the blame for the GFC.

What’s one reason that the stock market is going ham and P/E ratios are like a meth head who’s just fallen off the wagon post-rehab?

You guessed it - the GOV, knowing that it was blowing banks up with unexpectedly high yields through The Fed’s oil price and VIX battles, quietly rescinded The Volker Rule and not only allowed the banks back into the stock market but provided (and is still providing) them with the money to do it.

To put it bluntly, the US taxpayer is funding the “too big to fail” banks with money to gamble in a massively overinflated stock market because they are getting hammered on their other risky and improperly hedged bets.

What could ever go wrong?

If history serves as any indicator…everything. Everything could go wrong.

So what stonks are these banks and other big players (institutionals) investing in with that free (taxpayer) money?

I’ve talked repeatedly about how 5 stocks are driving pretty much the entire market on the Shitshow Macro Weekly Prep and Wrapup podcasts for premium subscribers.

On the day that I’m writing this section (June 12), Apple stock went straight up and JPOW just announced that there will be no rate cuts as of now, nor likely will there be any this year (2024).

In a normal, rational market, that would be bad for the stock market.

We aren’t in a normal, rational stock market, as described above.

Not only did JPOW and The Fed decline to lower rates, but Apple recently announced that it has slowing sales, no real innovation (outside of a new calculator app - whippie!) and its only real innovation has been in finance (stock buybacks) rather than technology.

And yet the stock went up by something like 3000 bps in a straight line today.

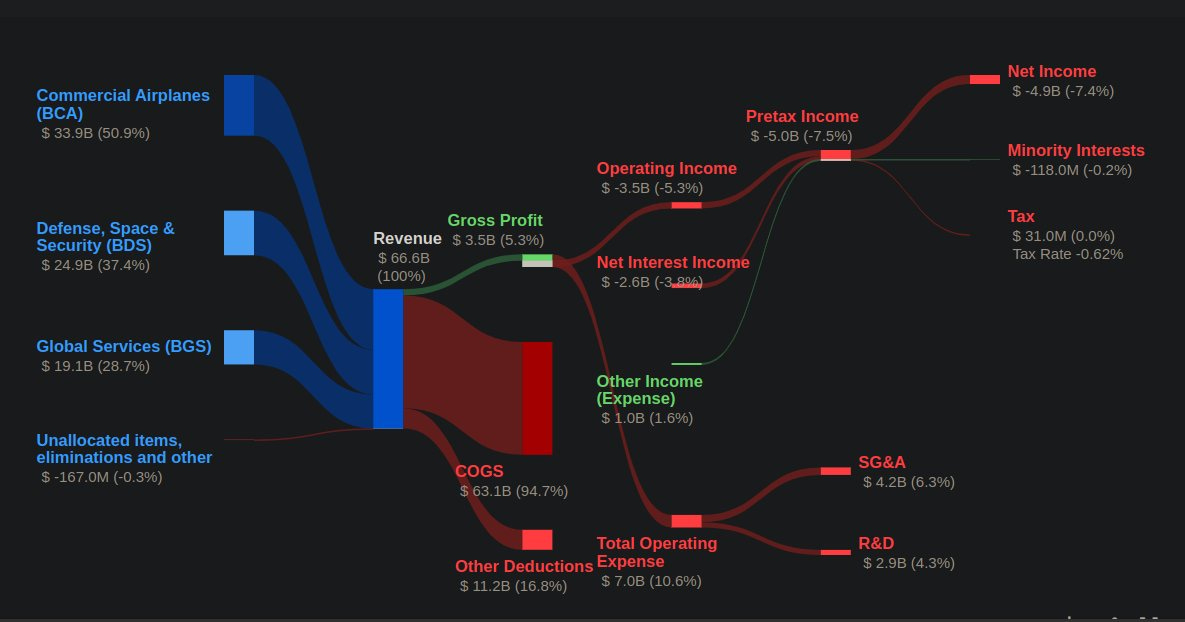

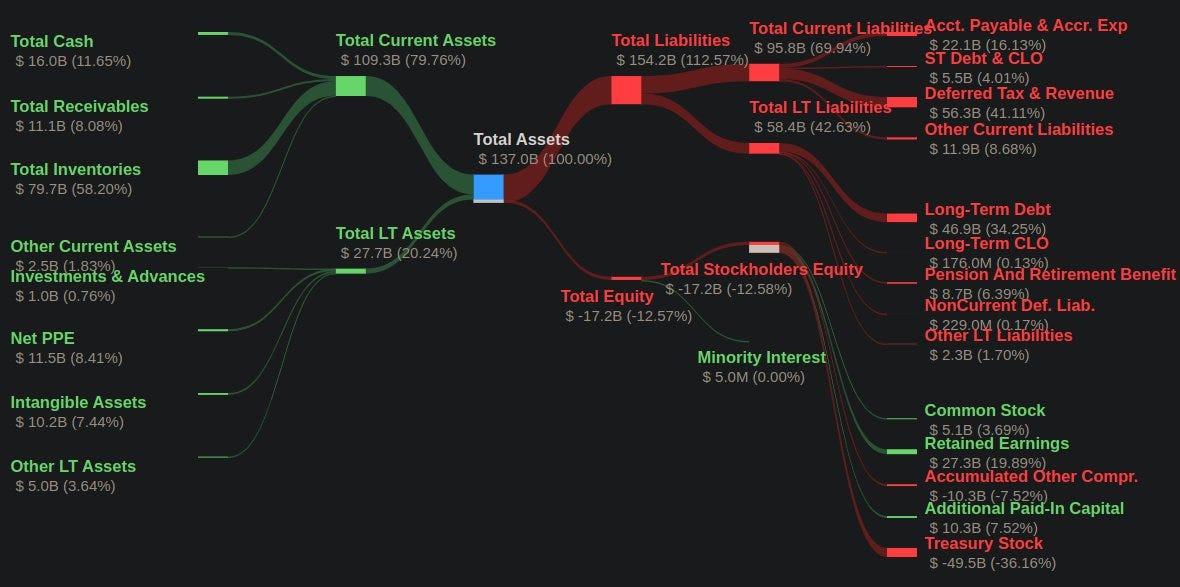

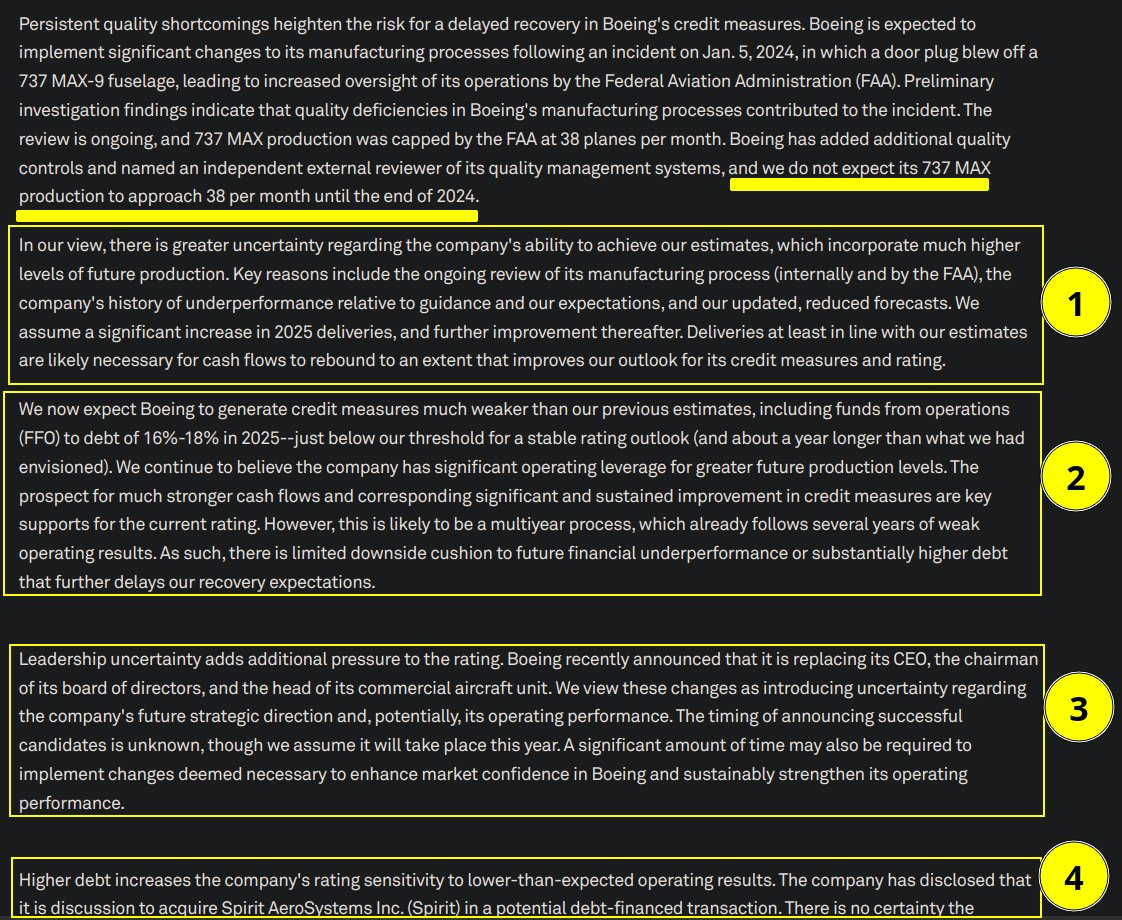

Another perfect example is Boeing - or as our friend who has provided a lot of content for our post today calls it - Boing.

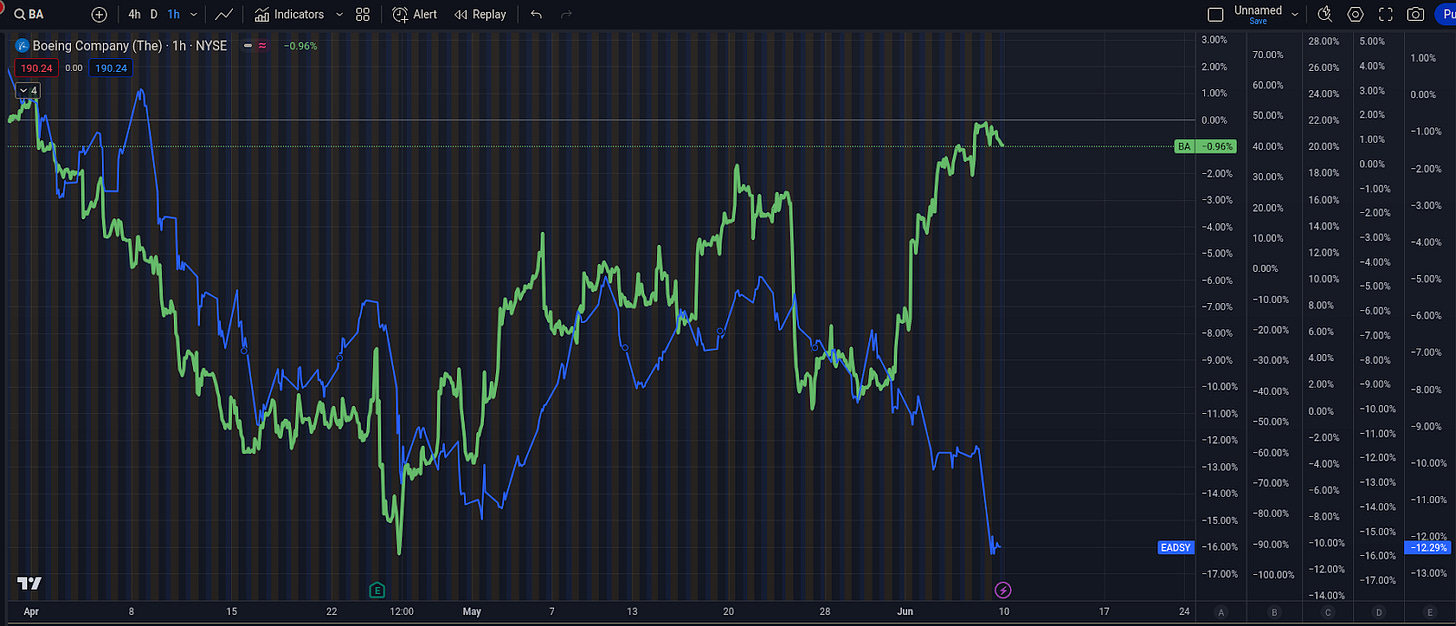

Here’s another thread that he called Market Analysis 201 that highlights just how much of a Shitshow Boing (Boeing) is, yet its stock keeps going up and up and up:

https://x.com/frankoz95967943/status/1799360512054251859?t=YAmpDoE2EmkGbK1A1Qx-fw&s=19

I want to help those who struggle with understanding core market mechanics - and why puts haven’t been working (and some calls)...

I will use Boing as an example - it’s a total shit company and dead man walking.

Boing does not deserve a $190 share price.

I’m sorry to longs - it just doesn’t. Here’s just 2 of the reasons…

Shareholders are getting liquidated - the company is printing shares like crazy. This will drive down Earnings Per Share (EPS).

It has missed almost every earnings announcement over the past 2 years.

“Then Oz, why the f is it nearly 30bps?!?!?”

Ya - that - and the point of this thread. You can use this analysis for any stonk.

First - VIX crush puts MASSIVE upward pressure on the stonk - it destroys the option premium.

I sold a put that a month ago was over $1,500. It is now $50. In 1 month. And it’s got another 40 days until expiration.

That’s how extreme this vol (volume) pressure is.

And 2 - bond yields - bonds are correlated to the VIX and currencies and exchange rates.

Think of the long bond as the US currency. If the yield goes down, that means money is CHEAP - and it’s hyper stimulative…

Notice the tight correlation - you got hyper-crushed VIX and cheaper money - most stonk has soared with this combination of variables.

Boing could crash 100 planes and it wouldn’t matter with this kind of upward pressure.

And remember - the big boys - and I mean the banks - have unlimited funding from the USGOV.

And they have “private equity” books - meaning they trade for themselves.

When they see VIX go down and yields go down? They use that money they borrow from the GOV and buy stonks.

And a lot of this trading is automatic…

I’ve covered the VIX extensively - think of the VIX going down as “MAX RISK ON” - and they take that free gubmint money and go all in - on everything - no matter even if the company reported Free Cash Flow (FCF) will be negative and the CEO just murdered 350 people…

Specifically for Boeing - they got NUMEROUS 3 & 4 letter agencies digging into their shit now - the FBI, DOJ, FAA, NTSB, and the SEC - all actively perusing some wrongdoing, all at the same time + multiple whistleblowers coming forward saying these flying coffins are death traps…

None of it matters…

The other side of this is liquidity - the spread between the 30y and 5y bond.

When this spread widens (goes up) stonks tend to follow - think of this as an intra contra carry trade - borrow cheap from spreads to generate money to trade with.

Banks are masters at this.

When liquidity explodes higher, so do the stonks…

Then there is their foreign capital - and it’s the same shit.

US 30y - JP30y

When these spreads are rising and you are short with puts?

You’re about to get fried…

And then there’s the added bonus of VIX crush…

Markets can continue to expand if they keep getting liquidity injections.

Even if the valuations no longer make sense.

Now putting it all together in a handy dandy formula.

Notice on the left it knew before the stonk did that Boing was gonna crash…

Now look what happened on the right side…

“Dead man walking…”

BATS:TLT^(120-BATS:UVIX)*(TVC:US30Y-TVC:USO5Y)

*for non-traders, the above is a formula for Trading View to recreate the charting below

SPY (*a mini tracker and way to invest in the S&P 500 without paying SPX prices) is way out in left field because of a few stonks:

So we zoom in:

Same goes for the q’s (QQQ, a tracker for NASDAQ):

IWM (iShares Russel 2000 ETF):

Banks get it:

Consumer discretionary doesn’t know they just got shot:

Back to Boing - not only has Boing not learned anything, they actually gave the lame-duck CEO a 45% pay raise…for failure…

Calhoun hails from GE, the Jack Welch “slash and burn” style of US executive management - run the company like a hedge fund and eliminate every cost possible - esp Quality Control…

And the new CFO?

*Also* comes from GE…

They *JUST* hired this guy:

Welch believed in “rank and yanks” and this is almost universally been adopted by most Fortune 500 companies.

The goal is to offshore and outsource as much as possible whenever possible.

Underperformance includes halting assembly due to quality problems - this isn’t profitable. So the folks who speak up are quickly transferred or shown the door.

It’s why Boing sucks so bad now (and most of the rest of corporate America, for that matter).

Stonk goes down when bond yields go up - unless someone is fucking with market mechanics.

Well, guess what?

On this chart is the 10y yield - when it goes up it means it costs a lot more money to rent money (like higher interest payments on your house, car, credit cards).

At the same time, The Fed crushed the VIX.

And we are at extremes now.

And notice how tightly the SVIX and 10y bond yields are now very tightly coupled…

This isn’t a free market.

Not even close.

Back to Boing - let’s compare Boing to their top competitor, Airbus…

Airbus is producing a LOT more planes than Boing - and they aren’t under investigation by the SEC, FBI, NTSB, FAA, with whistleblowers emerging right and left, etc.

So why is Boing outperforming Airbus?

Boing is producing less than half the airplanes as Airbus and the stonk is performing like it’s taken the lead in aerospace…haha no - it hasn’t.

And not only that, what it has been delivering is shit problematic planes.

4 days ago (this thread was posted on June 8, 2024), the people in Canada that make the landing gear for the plane went on strike…

One or three of these are severely mispriced:

And don’t forget - Boing was just downgraded to near junk status on its bonds - it means raising capital for the company is now hyper-expensive, on top of already high bond yields…

Boing is a cash-burning machine:

With liabilities far greater than assets:

Make it make sense:

https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/sourceId/13056793

Moving back to my insights and away from the thread from the man who uncovered and quantified what I could not…

Do you still think we live in a free market, capitalism-driven economy?

There’s a reason these posts were titled Masks Off.

In the next (and hopefully last) post within this Masks Off series, we will cover:

Foreign policy

The surveillance state

FISA and 702 are different things

The (Global) Censorship Industrial Complex

Trump is Merely an Archetype

I’m terrible at asking others for things, but…

It’s my intention to keep this platform free to read, but with the ability for people to donate if they are so inclined and feel the content here is worth their hard-earned dollars. These posts take quite a bit of time and research, but as I work it into my routine the flash-to-bang on new posts should reduce dramatically.

If you are so inclined and feel this is worth your time to subscribe for updates, share with others, or become a paid member, I’d greatly appreciate it.

Regardless, we’re all in this shitshow together. I’m going to do what I can to help you see the bigger picture and keep your eyes on the things that matter.

Until next time,

RPL